Springfield’s sales tax revenue intake accelerated sharply during the past two years, but the city’s director of finances is urging the City Council to prepare for a braking zone.

From 2020 to 2022, sales tax generation in Springfield climbed from about $46.6 million per year to a projected $54.7 million per year, a two-year total gain of about 17 percent.

“We’ve seen just tremendous growth in sales tax coming out of the pandemic,” said David Holtmann, Springfield Director of Finance.

Like an informed driver speeding east on the James River Freeway, Holtmann is watching for the telltale orange barrels that mark construction zones, preparing to decelerate. Holtmann points to the injection of federal funding, like economic stimulus dollars from the U.S. Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 and the American Rescue Plan Act (ARPA) of 2021, as key sources of Springfield’s prosperity in commerce during the COVID-19 pandemic.

“The downside of that, as we are seeing right now, is that is really impacting our inflation rate, which this past month was about 8.5 percent (annually),” Holtmann said.

As Holtmann takes a financial look in Springfield’s rearview mirror, he notes sales tax revenue climbed at an average of about 3 percent per year from 2013 to 2020, scaling up from $38.5 million in 2013 to $47 million in 2020.

“We really did not anticipate the significant growth that we’re seeing in sales tax,” Holtmann said.

According to the figures that Holtmann supplied to the Springfield City Council at a budget session on April 26, sales and online use tax revenue is up 15.9 percent from 2021 to 2022. Sales tax makes up about 36 percent of the city of Springfield’s overall budget, and about 60 percent of the city’s general revenue fund.

While developments like a new HyVee, a Costco store, the Envoy Air aircraft maintenance facility at the Springfield-Branson National Airport and the CoxHealth “super clinic” on East Battlefield Road are all helping inject more money into Springfield’s coffers, Holtmann is cautious about making long-term financial plans as he watches inflation rates.

“At some point, that’s going to start dragging on the economy, and we don’t think we’re going to be able to sustain” these levels of growth, Holtmann said.

The city of Springfield uses Moody’s as its independent investment and financial rating agency. Moody’s assigns ratings to government entities based on their ability to borrow money and repay it, assigning an overall rating for creditworthiness. The city of Springfield has an “Aa1” rating from Moody’s, the second-highest rating on the scale.

“We can issue debt at a very low cost because investors know that we have the capacity to pay that debt,” Holtmann said.

Median household income lags below average

Holtmann noted some cautionary items in Moody’s assessment of Springfield.

As of February 2022, Springfield has a base unemployment rate of 2.7 percent. Unemployment spiked as high as almost 10 percent of the Springfield workforce in April 2020, but has trended below its average rate of about 3.5 percent in the years prior to the worldwide pandemic.

Springfield’s overall population was 169,176 as of April 1, 2020, according to the U.S. Census Bureau. It is estimated that 59.7 percent of that population is part of the civilian workforce.

“Over a 10-year period, the city’s growth has been about 6.8 percent, whereas in the metro, it’s about 9.3 percent,” Holtmann said.

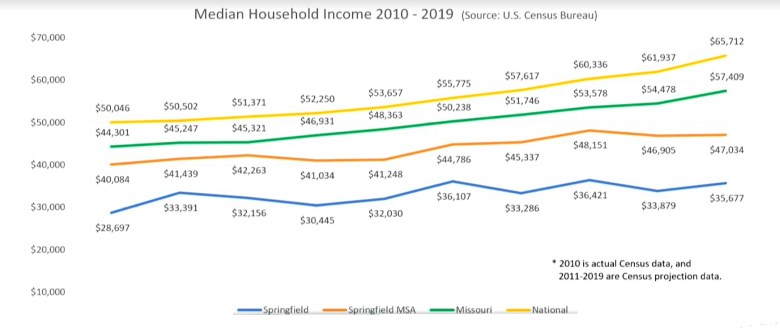

Springfield’s per capita income in 2020 was $24,438 per year, according to the U.S. Census. Moody’s notes Springfield’s median household income, according to the U.S. Census, is $35,677 per year, a figure that is just 54 percent of the national average median household income of $65,712, as of 2019.

“They cite that there is a relationship to the number of college students that we have that impact that lower index, but as we know, one out of four of our residents in Springfield live in poverty — one thing that we need to be aware of moving forward,” Holtmann said.

The Springfield metropolitan statistical area (MSA) had a median household income of $47,034 in 2019, which is about 71.6 percent of the national average.

Boosting the rainy day fund

The Moody’s bond rating is one of four key factors that Holtmann says illustrate the Springfield city government’s financial health. He also pointed to reserve or rainy day funding, debt loads and revenue stability as factors that show the health of the city’s finances.

Money comes into Springfield’s city government from a range of sources, but Moody’s notes Springfield’s “reliance on economically sensitive sales tax revenue” as a cautionary point.

Payments in lieu of taxes (PILOT or PILT), as defined by the U.S. Department of the Interior, are “federal payments to local governments to help offset losses in property taxes due to the existence of nontaxable federal lands within their boundaries.” Payments in lieu of taxes also may be imposed on municipally-owned utilities, of which Springfield City Utilities is one. Springfield also takes in money from licenses and fines, gross receipt taxes on sales by corporations, cable revenue and cigarette tax, among other sources.

The boost in sales tax has been applied to build up a reserve fund, with the goal of having a 20-percent reserve on hand. The intent of a reserve fund is that it could be used to keep a local government operational in a wide scale emergency, in the event that several or all sources of income were suddenly cut off.

“Currently, that rainy day fund is $17.4 million,” Holtmann said. “Because of all of the additional revenue that we have received due to higher sales tax, PILOT revenues and other city revenues that we have received throughout the year, that will grow to about $19.6 million for the upcoming budget. We’ve gone from about an $87 million budget to almost a $100 million budget, as we do, we increase our reserve capacity to make sure we have funds set aside.”

Start of the budget process

Councilman Andy Lear pointed out that not all sales taxes in Springfield can go to general revenue funding, where it can be spent at the City Council’s discretion. Some sales tax revenue is tied to certain projects and entities.

“The city gets 1 percent that goes to our general fund, which is, again, available … for about anything within our budget that we want,” Lear said.

Springfield collects a 1-cent sales tax for general revenue, a 3/4-cent sales tax for police and firefighter pensions, a 1/4-cent capital improvement sales tax for infrastructure improvement projects and a 1/8-cent transportation sales tax for streets.

The meeting April 26 was the first of four budget study sessions that the Springfield City Council will conduct. On May 31, the City Council is slated to take up and read a 2023 budget bill for the first time, with a plan to hold a second reading and final vote for adoption on June 13.

The Springfield City Charter requires that the budget provide a “complete financial plan” for the upcoming fiscal year, which is July 1, 2022 to June 30, 2023. The budget will contain itemized statements of expected expenses, itemized statements of expected incomes, some contingencies and a general budget summary.

By law in the charter, expenditure estimates may not exceed income estimates.

Springfieldians will be able to view and download budget documents starting on or about April 29, at the city’s website, http://springfieldmo.gov. Hard copies of the proposed 2023 budget will be available from the city’s finance office at a cost of $40 each, which Holtmann said covers the cost of printing the documents.